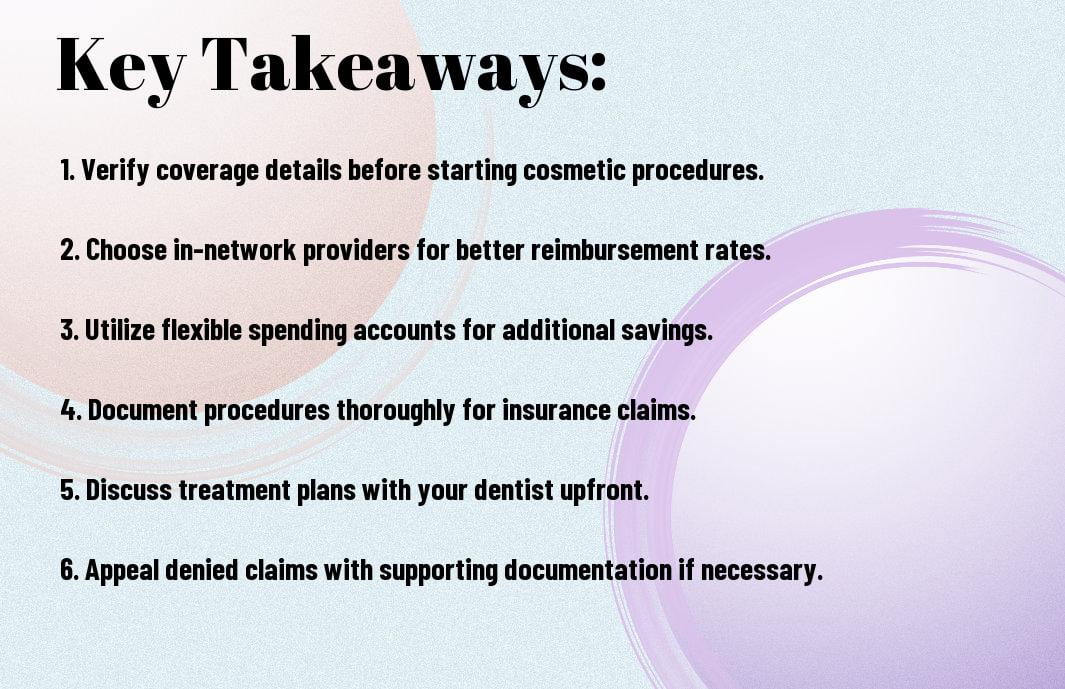

Insurance can often feel like a puzzle when it comes to cosmetic dentistry, but you can unlock its potential with the right strategies. Understanding your policy is crucial; not all procedures are covered, so it’s vital to know what your plan includes. By utilizing pre-authorization requests, you can clarify coverage details before treatment begins. Additionally, maintaining thorough documentation of dental issues could help you leverage your benefits more effectively. With these tips and best practices, you’ll be well-equipped to maximize your insurance benefits and invest wisely in your smile.

Understanding Cosmetic Dentistry

Your journey into the world of cosmetic dentistry begins with understanding what it truly encompasses. Cosmetic dentistry primarily focuses on enhancing the appearance of your teeth, gums, and smile. It is an elective procedure that significantly improves your aesthetic appeal and is often sought by individuals looking to boost their confidence and self-esteem. While some cosmetic procedures can also enhance functionality, their main goal is aesthetics.

Definition of Cosmetic Dentistry

On one hand, cosmetic dentistry is a specialized branch of dentistry that combines art and science to create beautiful smiles. Unlike traditional dentistry, which treats dental issues like cavities and infections, cosmetic dentistry concentrates on improving the visual aspects of your dental health. This can include procedures aimed at reshaping teeth, correcting gum symmetry, or transforming the overall appearance of your smile.

On the other hand, it encompasses a variety of techniques and treatments, allowing you to choose what aligns best with your goals and expectations. Whether you’re considering whitening treatments or a complete smile makeover, understanding the definition of cosmetic dentistry will help you navigate your options more effectively.

Common Procedures and Their Costs

Cosmetic procedures vary greatly in terms of complexity, duration, and cost. Common procedures include teeth whitening, veneers, dental bonding, crowns, and orthodontics like braces or Invisalign. Depending on the complexity and materials used, these procedures can range from a few hundred to several thousand dollars. For instance, teeth whitening might cost between $300 and $800, while veneers can set you back anywhere from $1,000 to $2,500 per tooth.

Cosmetic enhancements can often yield long-lasting results, making it an **investment in your smile and your confidence**. It’s also important to consider that some insurance plans may partially cover certain procedures, especially if they serve a functional purpose or improve your overall oral health. By knowing the financial aspects and potential insurance benefits, you can make informed decisions.

Importance of Aesthetic Oral Health

One of the crucial aspects of your overall health is the aesthetic appearance of your oral health. It is not just about having a pretty smile; a well-maintained set of teeth can contribute significantly to your self-esteem and social interactions. Many people feel more confident when they can smile freely without being self-conscious about their dental appearance. This, in turn, may lead to improved personal and professional relationships, as a pleasing smile often leaves a lasting impression.

One might underestimate the psychological benefits of a beautiful smile, but the impact it has on your life can be significant. Studies have shown that individuals who invest in their dental aesthetics often report higher levels of satisfaction in their personal and professional lives. Aesthetic oral health plays a vital role in how you feel about yourself and how others perceive you, making it a powerful element of your overall well-being.

Aesthetic treatments not only enhance your smile but also help in maintaining your oral health; after all, your smile is one of the first things people notice about you. By prioritizing the aesthetic aspect of your oral health, you are indeed investing in both your confidence and your livelihood.

Types of Insurance Policies

If you’re navigating the world of cosmetic dentistry, understanding the types of insurance policies available is paramount to maximizing your insurance benefits. Each type of policy can offer different levels of coverage for your cosmetic procedures, so it’s vital to know what each entails. Here are some key types of policies you may encounter:

| Policy Type | Description |

| Health Insurance | Covers medical expenses, with limited coverage for dental work. |

| Dental Insurance | Focused on dental health, often covers preventive care, but may have caps for cosmetic procedures. |

| Supplemental Insurance | Offers extra coverage for services outside of standard health or dental policies. |

| Discount Dental Plans | Provides a set discount on dental services for an annual fee. |

| Flexible Spending Accounts (FSA) | Allows you to use pre-tax dollars for qualifying medical expenses, including some dental work. |

Health Insurance vs. Dental Insurance

One of the vital distinctions is between health insurance and dental insurance. Health insurance typically covers necessary medical procedures and may offer limited coverage for dental services, but it’s rarely comprehensive when it comes to cosmetic dentistry. For instance, while you may find some coverage for tooth extractions or surgeries, aesthetics will often fall outside the scope of health insurance policies.

On the other hand, dental insurance focuses specifically on oral health and care. While many dental policies include preventive services like cleanings and x-rays, they may impose strict limits or exclusions on cosmetic procedures such as veneers or teeth whitening. Understanding these differences will help you to strategically plan how to maximize your benefits based on your needs.

Examining Cosmetic Dentistry Coverage

Cosmetic dentistry can be quite expensive, so it’s crucial to thoroughly examine any potential coverage you might have. Cosmetic procedures often don’t fall under traditional insurance policies designed primarily for functional dental work. Understanding the specifics of your policy will allow you to discern what treatments may qualify for coverage.

Cosmetic procedures like dental implants, bonding, and orthodontics can qualify for coverage based on medical necessity rather than purely aesthetic appreciation. It’s advisable to consult your insurance provider for clarification on specifics and to get recommendations on how to maximize your refund on these often costly services.

The more you know about your policy, the better positioned you will be to take advantage of any available benefits. Be proactive: contact your insurance provider to get a clear picture of what is covered regarding cosmetic procedures.

In-Network vs. Out-of-Network Providers

Insurance plans typically categorize providers as either in-network or out-of-network, dramatically affecting your out-of-pocket expenses. When you choose an in-network provider, your insurance company has negotiated reduced rates, making treatments more affordable. However, opting for an out-of-network provider can result in higher costs and reduced coverage, leading to surprise bills.

It’s advisable to check with your insurance provider regarding the details of their in-network list. Understanding these distinctions allows you to make informed choices that can save you money while receiving the care you desire.

Understanding your policy and the network options effectively can make a significant difference in your overall expenses. Always double-check the provider status and associated costs to ensure that you maximize your insurance benefits.

Perceiving the variations in coverage, provider networks, and services included in your insurance policy will empower you to make decisions that align with your financial and dental care goals.

Strategies for Maximizing Benefits

Unlike standard dental procedures, cosmetic dentistry often falls into a gray area when it comes to insurance coverage. However, by employing certain strategies, you can greatly enhance your ability to maximize insurance benefits for these procedures. Understanding the nuances of your policy, obtaining pre-authorization, and effectively documenting medical necessity are pivotal steps in this process.

Understanding Your Policy

With a wide variation in insurance policies, it’s crucial to carefully review your coverage details. Identify specific clauses related to cosmetic dental work, as different insurers may classify procedures differently. Some of them may provide partial coverage for treatments that serve a dual purpose, such as enhancing function alongside aesthetics. This knowledge can empower you to make informed decisions regarding your dental care and financial commitments.

Additionally, don’t hesitate to contact your insurance provider for clarification. Ask specific questions about what is covered and what documentation may be required. Knowing your policy inside and out can significantly influence your approach and enable you to secure the best possible benefits.

Getting Pre-Authorization

An effective way to ensure your cosmetic dental procedures are covered is to seek pre-authorization from your insurance company. This process involves submitting a request alongside a detailed treatment plan from your dentist, outlining the necessity of the procedure. By obtaining this authorization before starting treatment, you not only confirm coverage but also gain peace of mind knowing that your insurer is aware of the planned procedure.

Pre-authorization can be a crucial step, especially if you’re considering major cosmetic work. Insurance companies often require this as a way to prevent surprise costs down the line. Keep in mind that the approval process may take some time, so it’s wise to begin this step well in advance of your desired treatment date. This will allow you to address any issues that may arise without delaying your procedure.

Documenting Medical Necessity

Maximizing your insurance benefits also involves careful documentation of medical necessity. Many cosmetic procedures can be framed as important if they address underlying health conditions or if they significantly improve your quality of life. Your dentist can help you articulate these points by providing thorough notes and condensed diagnostic information that supports your case.

To strengthen your claim, gather any relevant medical records, photographs, and testimonials that can bolster your argument that the cosmetic procedure is medically necessary. By providing comprehensive documentation, you mitigate the risk of denial and possibly increase the amount of your claim that gets reimbursed.

Utilizing Flexible Spending Accounts (FSAs)

After considering the potential costs associated with cosmetic dentistry, it’s important to explore all available options to maximize your benefits. One such option is utilizing a Flexible Spending Account (FSA), which allows you to use pre-tax dollars for eligible medical expenses, including certain cosmetic procedures. By planning ahead and understanding how FSAs work, you can significantly reduce your out-of-pocket costs and make your desired treatments more affordable.

What is an FSA?

To put it simply, a Flexible Spending Account (FSA) is a tax-advantaged financial account that can be set up through your employer. Employees can set aside a portion of their paycheck on a pre-tax basis, which can then be used to cover qualified medical expenses throughout the year. This can lead to considerable savings since the money you contribute to an FSA is excluded from your taxable income, effectively lowering your overall tax burden.

Moreover, FSAs can be used for a variety of medical products and services, not limited to traditional healthcare costs. This flexibility makes them especially useful for those considering cosmetic dentistry procedures, as many related expenses can qualify for reimbursement, allowing you to get the most out of your benefits.

Eligible Cosmetic Dentistry Expenses

What you should know is that not all cosmetic dentistry expenses are eligible for FSA reimbursement, but several key procedures do qualify. Common eligible expenses include treatments like dental implants, teeth whitening, and orthodontic braces, provided they are deemed medically necessary. It’s crucial to keep in mind the guidelines set forth by the IRS when determining what qualifies as an eligible expense, as these can impact your ability to maximize your FSA funds effectively.

Spending your FSA funds wisely importantly means doing your research to determine which cosmetic dentistry procedures you would like to pursue and ensuring they fit within the definition of qualified expenses. It’s also wise to maintain accurate records, such as receipts and invoices, which can be necessary when filing for reimbursement or if your FSA provider requests proof of eligible expenses.

Deadlines and Usage Tips

Dentistry procedures can be time-sensitive, especially when it comes to using your FSA funds. Most FSAs require you to use the funds within a specific timeframe, often within the calendar year or grace periods defined by your employer. After the deadline, any unused funds typically get forfeited, which is why strategizing your spending is critical. Be vigilant about deadlines and prioritize any important cosmetic services that require immediate attention.

- Maximize your FSA by planning your cosmetic procedures early in the year.

- Keep records of all eligible expenses for a smoother reimbursement process.

- UtilIZE your FSA funds before they expire to avoid losing them.

Any decisions you make regarding your treatment plans should be well-informed, taking both your personal aesthetic goals and FSA deadlines into consideration.

Utilizing effective time management can also enhance your experience. Make a note of important dates, such as when your FSA plan resets and when your employer might provide updates about contributions and eligible expenses. Consider setting reminders on your phone or calendar to ensure you stay on top of your FSA usage.

- Stay up-to-date with your employer’s FSA policies, as they may vary significantly.

- Consult with your dentist regarding what treatments may qualify under your FSA.

- Analyze your cosmetic dentistry options ahead of any deadlines.

Any steps you take to ensure you’re on top of your FSA contributions and eligible expenses can lead to smoother financial management when seeking cosmetic dentistry.

Finding the Right Provider

All your efforts to maximize your insurance benefits for cosmetic dentistry will be in vain if you don’t have the right provider. It’s crucial to take the time to find a qualified dentist who not only understands your specific needs but is also experienced in working with insurance companies. This will help ensure that you receive the best possible care while minimizing out-of-pocket costs.

Researching Qualified Dentists

Any good start to finding a qualified dentist involves conducting thorough research. Begin by looking into local dental associations and boards for lists of accredited cosmetic dentists in your area. These organizations often have strict guidelines and standards that their members must adhere to, which helps guarantee a certain level of quality and professionalism. Additionally, consider browsing online reviews and patient testimonials to get a better understanding of prospective dentists’ reputation and suitability for your needs.

Once you have a list of potential providers, make sure to check their qualifications and credentials. Look for dentists who have completed specialized training in cosmetic procedures, as well as those who stay up-to-date with the latest advancements in the field. This not only ensures that you’re receiving high-quality care but also that your provider is capable of maximizing your insurance benefits by utilizing procedures that are covered under your plan.

Asking About Insurance Compatibility

Asking the right questions about insurance compatibility is necessary when selecting a cosmetic dentist. Before booking an appointment, reach out to your insurance company to clarify exactly what procedures are covered under your plan. Not all cosmetic options may be included, and having this information will guide you in formulating relevant questions when speaking with potential providers. Decide on which procedures you’re most interested in, and inquire if those specific services are covered by their practice.

With this information at hand, you can directly ask cosmetic dentists if they accept your insurance and which procedures they can assist you with. You may encounter providers who will work with you to create a treatment plan that complies with your insurance policy, thus maximizing your benefits. Remember that transparency is key, so don’t hesitate to request a breakdown of potential costs and the expected coverage for each procedure.

Importance of Reviews and Referrals

On your journey to finding the right provider, the importance of reviews and referrals cannot be overstated. Personal recommendations from friends, family, or even your regular dentist can lead you to trusted cosmetic specialists. Additionally, online reviews can provide insights into other patients’ experiences, helping you gauge the level of service and outcome you can expect.

For instance, a well-reviewed dentist may be more likely to prioritize your needs and effectively work with your insurance company. Pay attention to the common themes in these reviews—are patients satisfied with the results? Do they mention hassle-free billing processes? Understanding these details can significantly influence your choice of provider and ultimately contribute to a smoother experience in maximizing your insurance benefits for cosmetic dentistry.

Keeping Track of Expenses and Claims

Keep in mind that managing your expenses and claims effectively is crucial to maximizing your insurance benefits for cosmetic dentistry. An organized approach can alleviate stress and ensure you don’t miss out on potential reimbursements. When you track your expenses and keep records of your claims, you create a substantial advantage for yourself, especially when dealing with the complexities of insurance policies. Above all, staying organized can save you time and effort when it comes to managing your dental expenses.

Organizing Bills and Receipts

Keeping all your bills and receipts in one place is crucial for demonstrating the services you received and the payments made. Use a dedicated folder or digital file on your computer or mobile device to store scanned copies of your invoices and receipts from your dental visits. Label each receipt with the date of service, the provider’s name, and the specific treatment received. This will not only help you keep track of your expenses but also make it easier to refer back to documentation when you need to submit claims.

In addition to organizing your receipts, consider creating a spreadsheet or using financial-tracking software to log all your expenses related to cosmetic dental work. This will allow you to keep a comprehensive overview of your costs, which is especially useful during tax season or if you need to analyze the financial impact of your dental decisions.

Submitting Claims Properly

Organizing your claim submissions is another crucial factor in maximizing your insurance benefits. Before submitting a claim for your cosmetic dental work, ensure that you have all necessary documentation in order. This typically includes your treatment invoice, the provider’s tax identification number, and a filled-out claim form provided by your insurance company. Submitting incomplete or incorrect documentation can lead to delays or denials of your claims, resulting in you missing out on your entitled benefits.

Another important aspect of submitting claims properly is being aware of your insurance policy specifics. Familiarize yourself with the details of your coverage—including limits, exclusions, and necessary pre-approvals—for cosmetic procedures. Many insurance companies require a specific process before they will pay for services. Following these guidelines ensures a smoother claims process and improves your chances of receiving full or partial reimbursement.

Following Up on Claim Status

Bills for cosmetic dentistry can add up quickly, and the last thing you want is to be left in the dark about your claim’s status. It’s a good practice to follow up with your insurance provider a week or two after submitting your claim. Whether you used an online portal or submitted your claims through traditional mail, checking back can help you identify any issues that may arise. If there are questions or further information needed, you can address them promptly, avoiding unnecessary delays.

Receipts are your best friends in this scenario. When you contact your insurer, have all relevant information, including your policy number and receipts handy. This will help the customer service representative locate your claim easily and provide you with updates on its progress. Being proactive in following up not only keeps you informed but also demonstrates your commitment to ensuring that your dental expenses are taken care of by your insurance provider.

Final Words

Presently, maximizing your insurance benefits for cosmetic dentistry requires strategic planning and an understanding of your specific policy’s coverage. You should begin by thoroughly reviewing your insurance plan to identify what cosmetic procedures may be covered. Many policies include some level of coverage for restorative procedures, so it’s wise to differentiate between purely aesthetic treatments and those that support oral health. You can enhance your chances of receiving benefits by obtaining a pre-treatment estimate from your dentist, which outlines proposed procedures and associated costs, allowing you to present a clear case to your insurance provider.